Table of Contents

- ClimaSpec Structural Thermal Break Benefits

- Energy Efficiency and Increasing 179D Tax Incentives

- ClimaSpec Structural Thermal Breaks Improve Energy Efficiency

- Maximizing 179D Tax Credits with ClimaSpec Structural Thermal Breaks

- ClimaSpec and 179D Tax Incentives

ClimaSpec Structural Thermal Break Benefits

As an innovate structural thermal break manufacturer in the sustainable construction industry, we pride ourselves on leading energy-efficient construction practices. Our structural thermal breaks boast many benefits when incorporated into a building design. One benefit specifically is aiding with tax incentives such as 179D due to ClimaSpec Structural Thermal Breaks improving the performance of the building envelope.

Energy Efficiency and Increasing 179D Tax Incentives

Continuously escalating energy costs and environmental concerns highlight the importance of improving the energy efficiency of a building. Governmental initiatives like the 179D tax incentives offer an engaging reason for property owners and developers to invest in improving building energy efficiency.

Under the 179D provision, developers, architects, engineers, and design contractors that makes qualifying energy efficiency improvements to eligible commercial property can receive significant tax deductions. These deductions increased from up to $1.88 per square foot in 2022 up to $5.00 per square foot in 2023, rewarding those who embrace an energy-efficient building envelope, HVAC system, and lighting selection. To see if your project is eligible, click here.

ClimaSpec Structural Thermal Breaks Improve Energy Efficiency

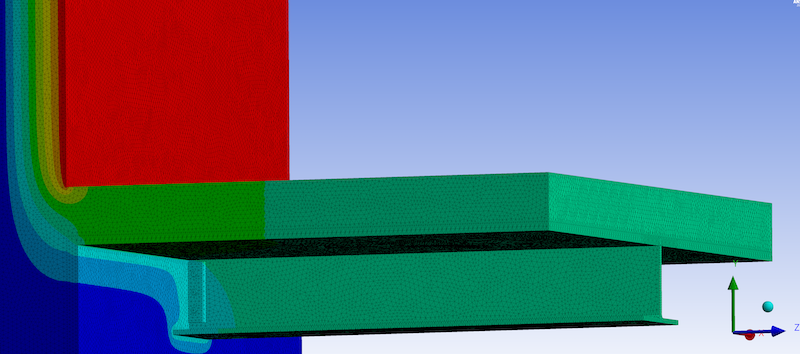

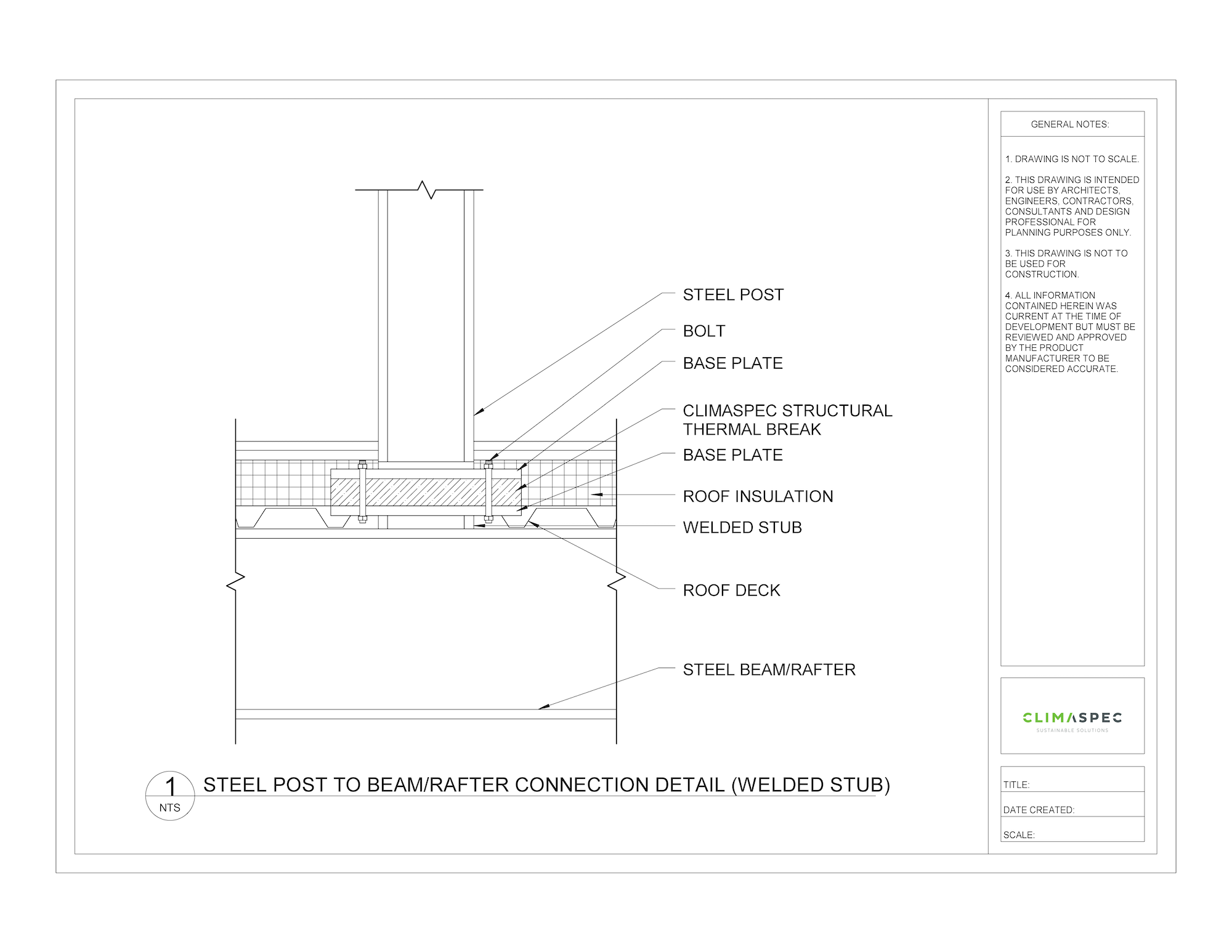

ClimaSpec Structural Thermal Breaks are an innovative, adaptable solution to reducing energy loss through a building envelope, also known as thermal bridging. ClimaSpec Structural Thermal Breaks effectively interrupt the transfer of heat between highly conductive structural elements, preventing energy losses that can reduce a building’s energy efficiency.

Our ClimaSpec Structural Thermal Breaks are engineered to minimize thermal bridging effectively due to our products exceptionally low thermal conductivities. This translates to reduced heat transfer and, subsequently, lower energy demands for heating and cooling systems. The result? A more energy-efficient building that aligns seamlessly with the goals of the 179D tax incentives.

Maximizing 179D Tax Credits with ClimaSpec Structural Thermal Breaks

Integrating our ClimaSpec Structural Thermal Breaks into building projects doesn’t just improve energy efficiency – it also increases the eligibility for the 179D tax incentives. Consider a scenario where a developer or proper owner is designing a commercial property and installing ClimaSpec Structural Thermal Breaks as a part of the building envelope assembly. Thereby, significantly reducing thermal bridging and increasing the building envelope energy performance. This, in turn, results in greater tax deductions under the 179D provision, directly impacting the project’s financial feasibility and long-term profitability.

ClimaSpec and 179D Tax Incentives

As a structural thermal break manufacturer, we believe it is important to educate the construction industry on the many benefits of designing with ClimaSpec products. Our structural thermal breaks improve building envelope design, energy efficiency, and the feasibility with 179D tax incentives. This synergy between innovation and financial rewards isn’t just a strategy; it’s a solution to a long-lasting commitment to sustainable building practices and a brighter future for generations to come.

Contact us today to discuss how ClimaSpec Structural Thermal Breaks can contribute to 179D tax incentives for your project.